We continue to refine our sustainability reporting to fulfil more stringent regulatory requirements and align with global best practices.

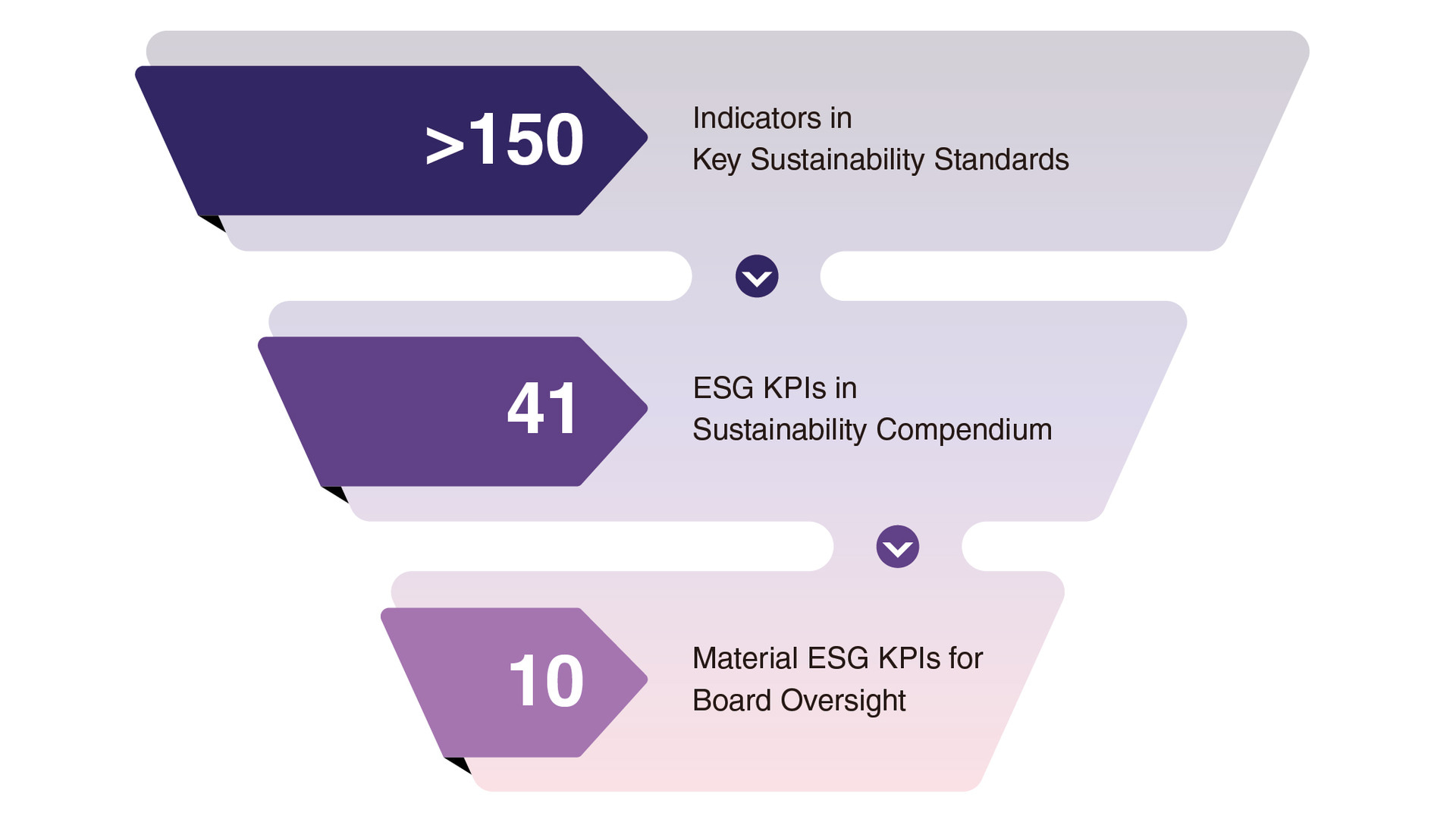

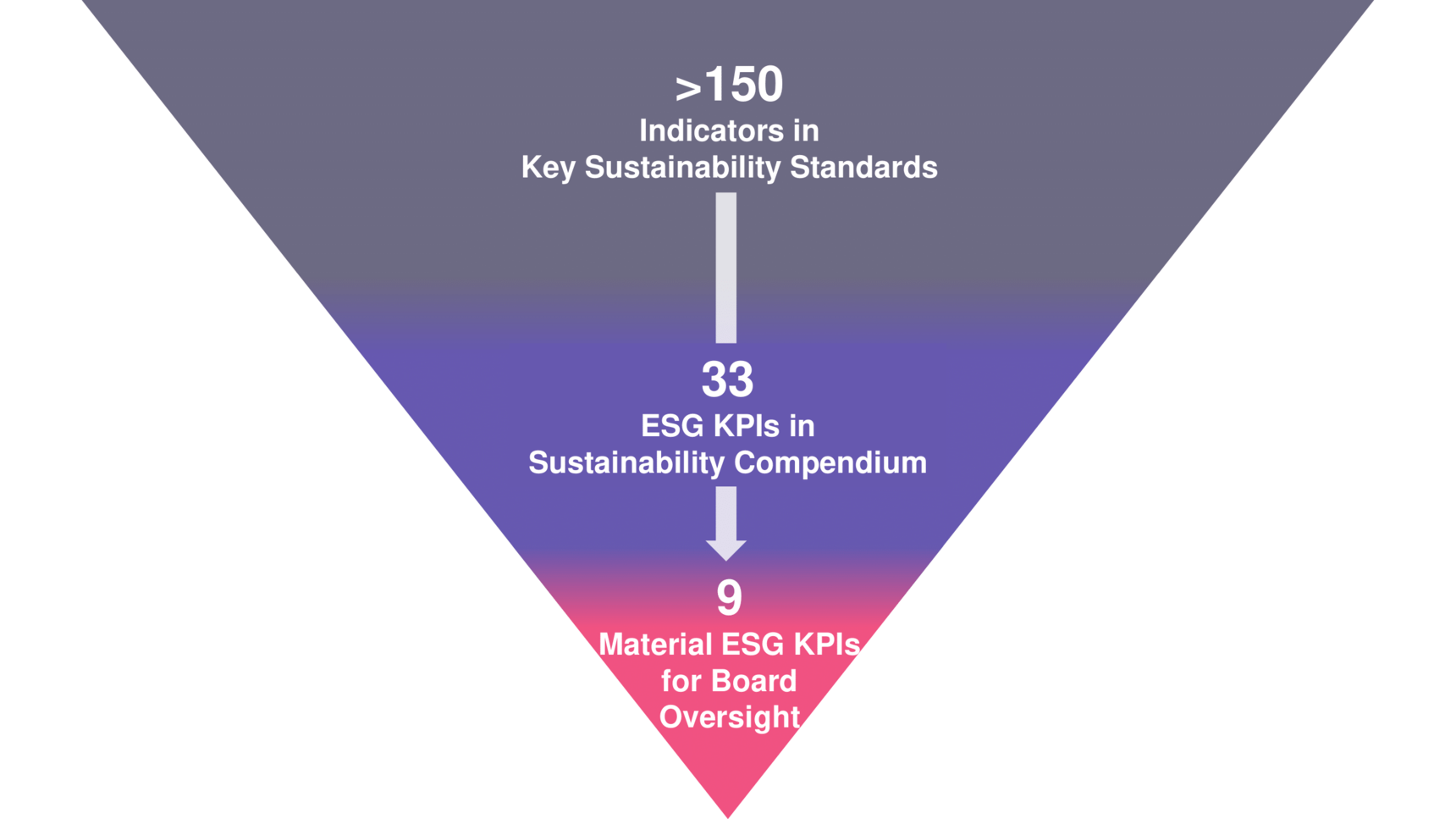

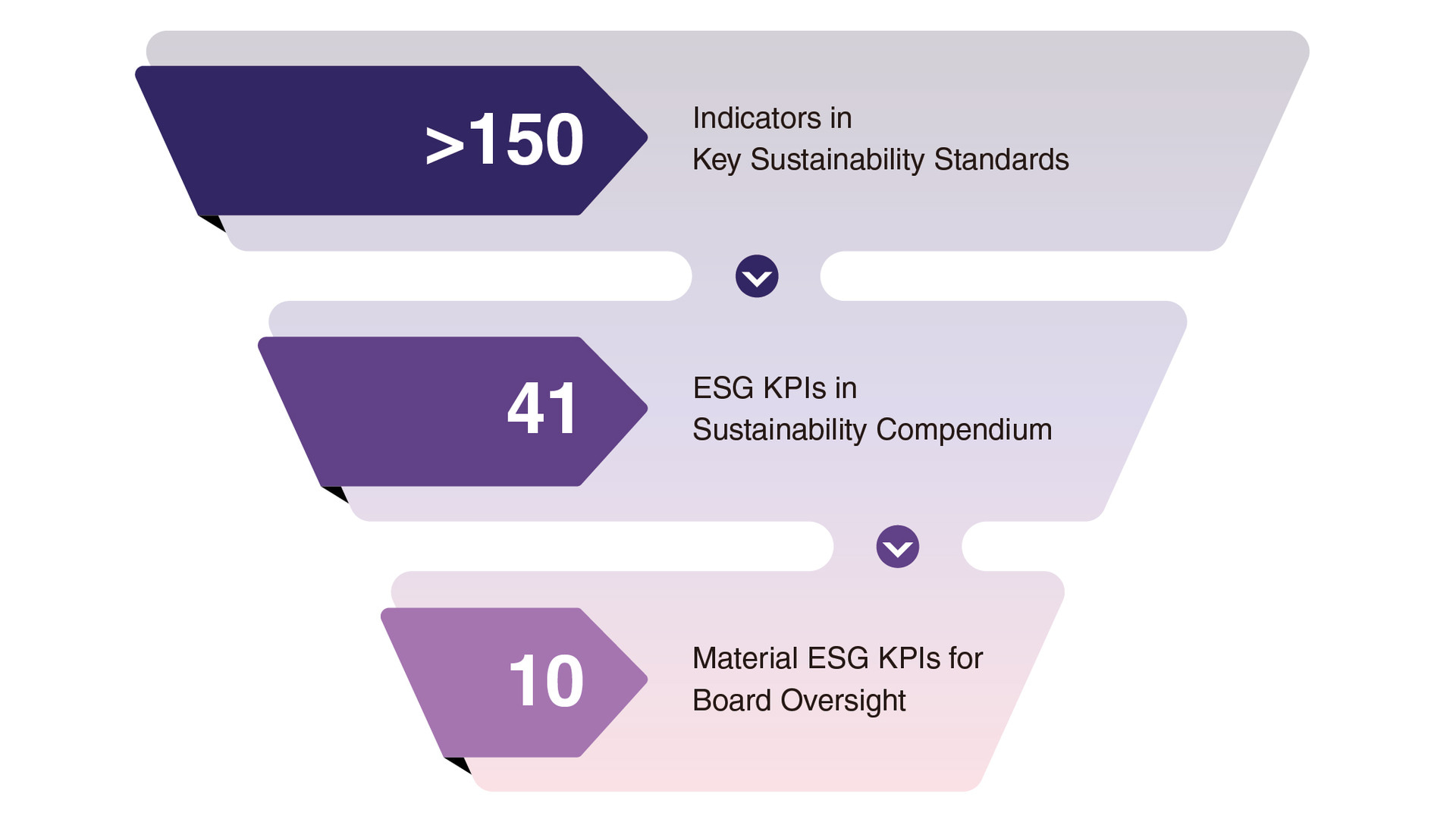

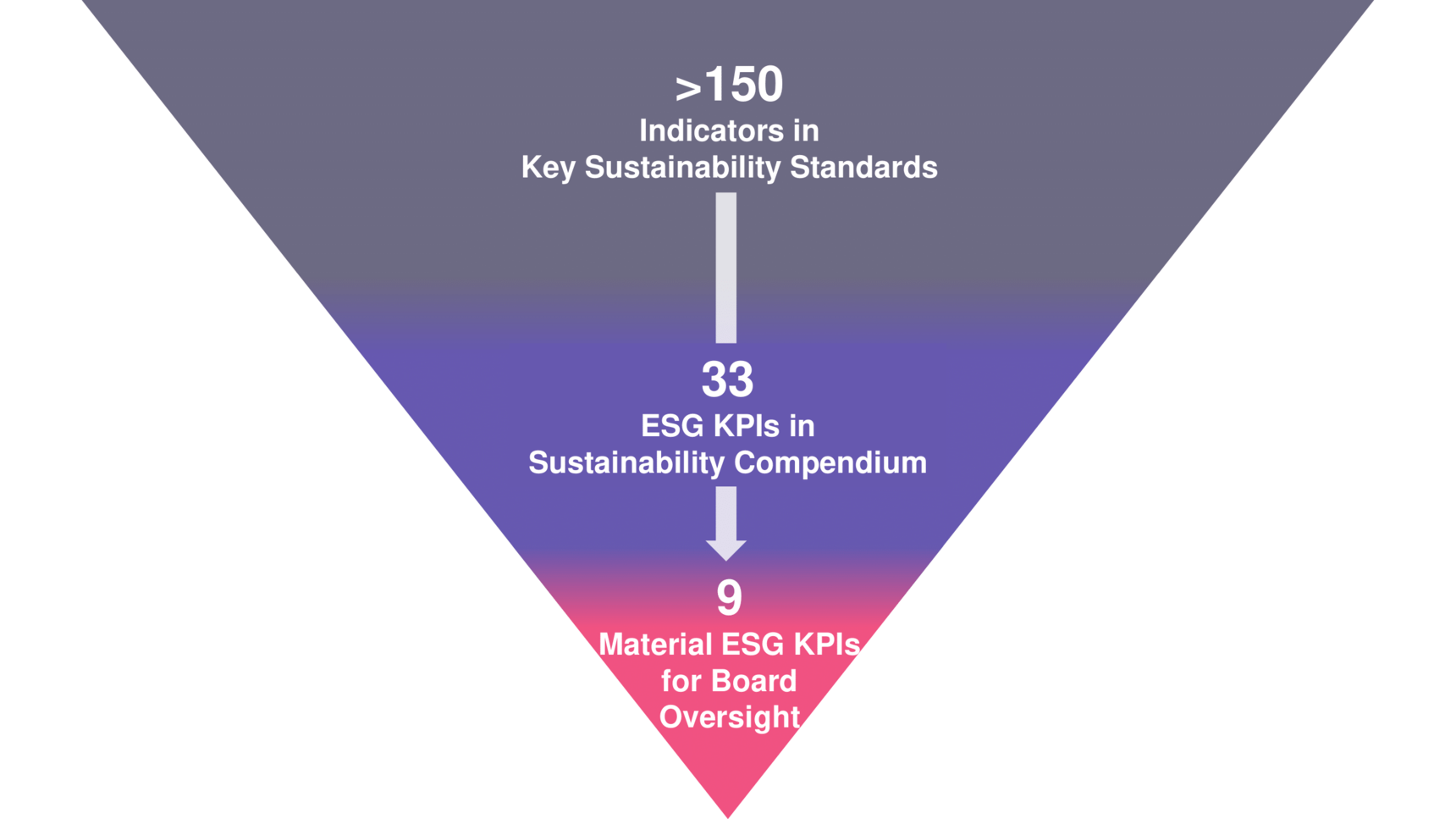

Each year, we report on over 150 indicators required by key sustainability standards, such as GRI Standards, HKEX “Environmental, Social and Governance Reporting Guide”, International Sustainability Standards Board (ISSB), and Task Force on Climate-related Financial Disclosures (TCFD).

To enhance accountability, in 2022/2023 we prioritised 9 ESG KPIs for Board approval and increased oversight. We selected these ESG KPIs by referencing our materiality assessment, our risk register and by following principles described in the ISSB disclosure requirements and by assessing their impact on Enterprise Value, Business as Mutual or our corporate reputation.

| Common Material Issues/Risks | Material ESG KPIs(1) | Areas Impacted |

|---|---|---|

| Talent Development and Retention (strategic) |

|

Business as Mutual, Reputational |

| Climate Change Resilience and Decarbonisation (strategic); Energy Efficiency (operational); & Waste Management (operational) |

|

Enterprise Value, Business as Mutual |

| Brand Awareness and Reputation (strategic) |

|

Reputational |

| Stakeholder Engagement and Management (strategic) |

|

Business as Mutual, Enterprise Value |

(1) Please refer to Appendix from our Sustainability Compendium for the definition and methodology of each material ESG KPIs.

(2) In 2023/2024, we started reporting electricity and carbon data for our Singapore properties. This inclusion has led to a re-baselining of our targets following Greenhouse Gas Protocol and SBTi guidelines due to significant changes in our company structure and inventory methods. The current values reflect the re-baselined target progresses.

(3) Compared to 2018/2019 baseline.

(4) Includes Scope 1 and 2 emissions.