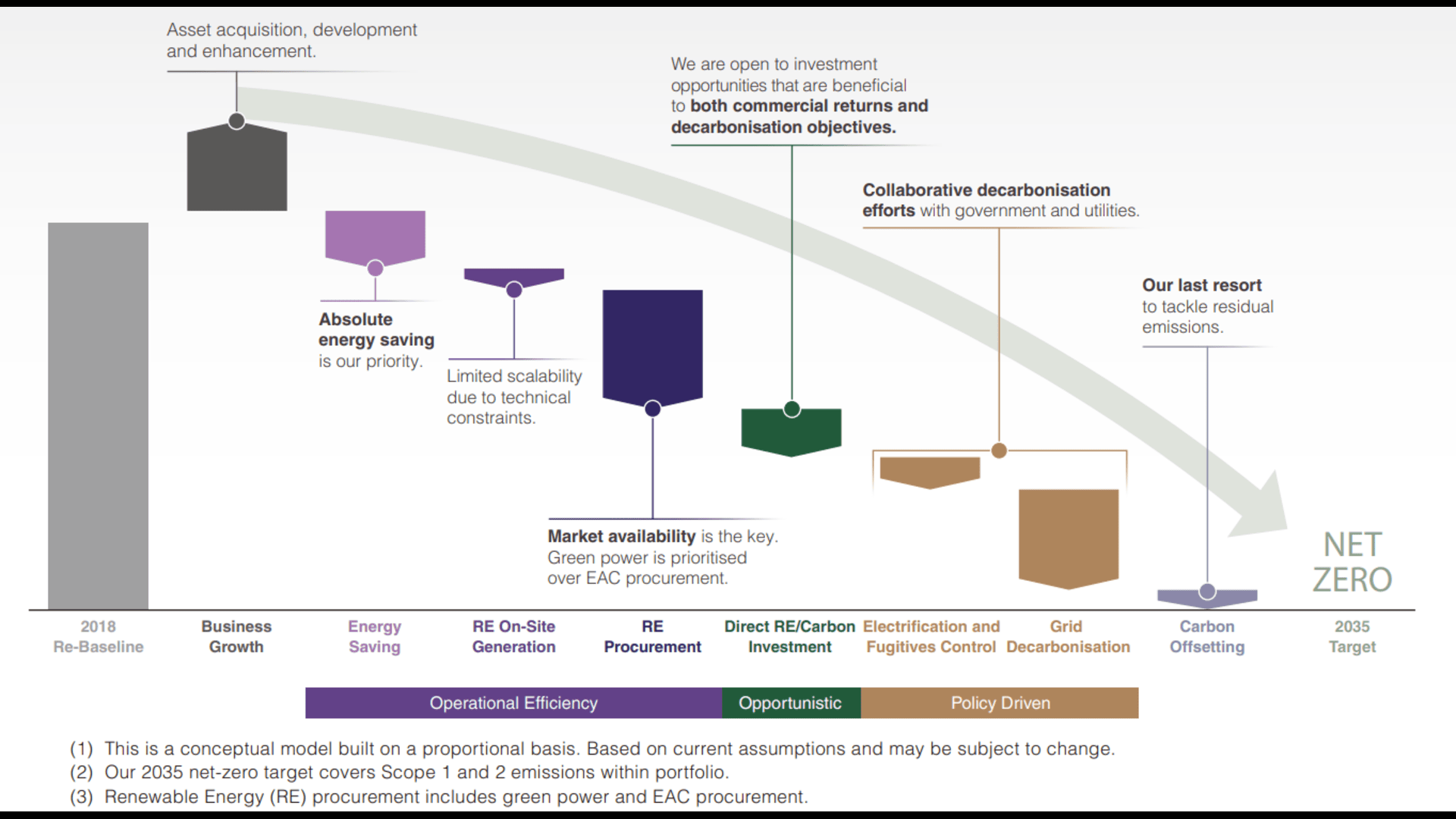

Six Levers for Long-Term Decarbonisation

Our decarbonisation strategy is built on six core levers that allow us to navigate operational realities, regulatory diversity and capital constraints across jurisdictions:

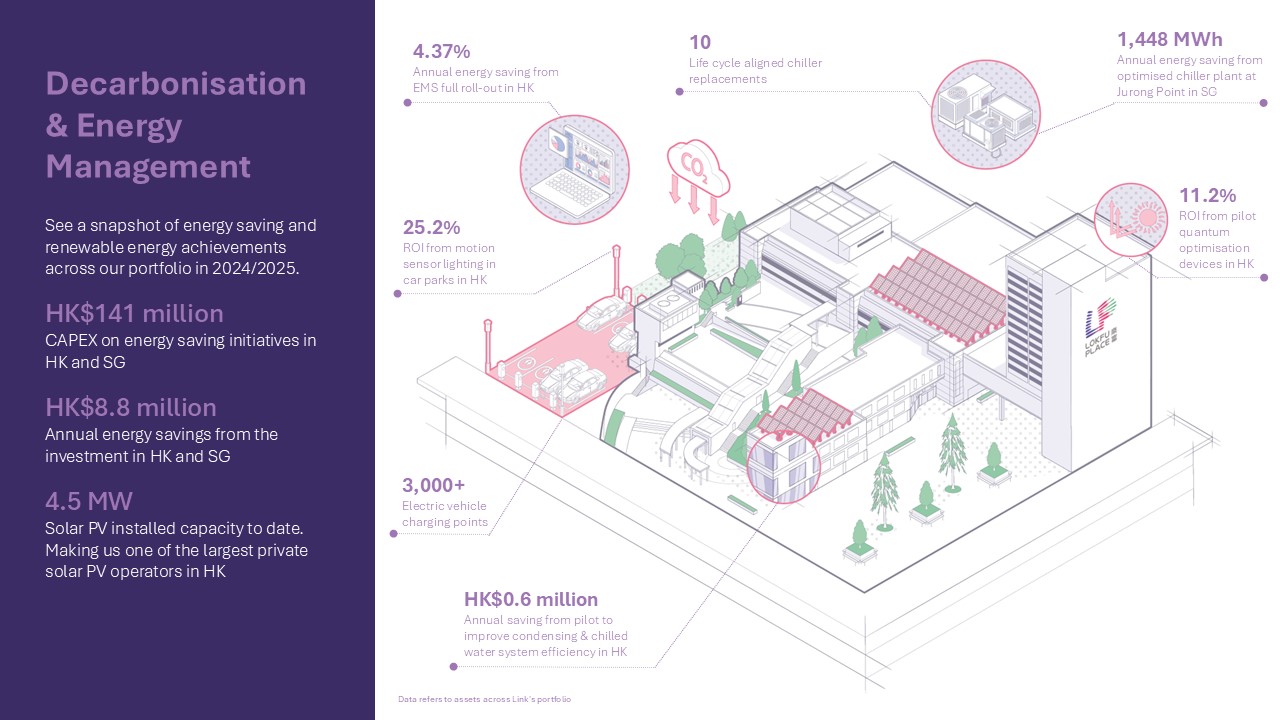

This is the foundation. From HVAC optimisation and chiller upgrades to LED retrofits and control system automation, we continue to drive down energy intensity at scale. Our EMS deployment programme, layered on 15 years of energy optimisation work, gives us a costefficient, high-control starting point.

Learn moreWe are one of the largest private solar PV operators in Hong Kong, with 4.5 MW installed across 53 assets. These installations generate more than 4,200 MWh annually. In Mainland China, we are deploying rooftop PV systems across three logistics centres, with a 17 MW pipeline underway. We are also exploring flexible solar systems that reduce load without compromising rooftop usability.

In jurisdictions where on-site generation is not viable, we are expanding our use of RECs and green electricity contracts. Our decisions here are influenced by both supplier readiness and the projected pace of grid decarbonisation, which varies widely across APAC markets.

We are exploring opportunities to invest in carbon sinks and removals such as buildingintegrated insets or nature-based solutions that can be tied to our assets. While still in early stages, we believe these will form part of our future carbon balance sheet.

Fuel mix optimisation addresses decarbonisation through two key approaches: adapting to regional grid transition timelines; and reshaping energy demand via electrification. By incorporating these considerations into our market expansion and electricity procurement choices, we ensure emissions reduction even when policy-driven improvements are slow.

Offsets are only considered for genuinely hard-to-abate emissions. We favour credits tied to emission avoidance (e.g. organic waste diversion or methane capture) and continue to explore self-generated credits within our own operations. We do not rely on offsets to meet near-term targets and view them as a backstop, not a strategy.